Globally, 30% of water fed into the grid is wasted due to losses of the water supply network. In London they reach 25%, in Norway 32% but in Italy losses are even higher. According to latest available data (ISTAT, Water Census 2015) the actual water loss exceeds 38% and the situation is worsening. Drinking water lost along the water supply distribution was 2.6 trillion m3 in 2008, increased to 3.1 trillion m3 in 2012 and reached 3.4 trillion m3 in 2015. These numbers should not come as a surprise if we consider that the Italian water network has a serious ageing problem: on a total extension of more than 337.453 km[1] of water system, 74.240 km are more than 50 years old; another 121.483 km are between 30 and 50 years old[2]. Furthermore, the activity of monitoring of water losses is carried out with advanced techniques only on 47.243 km and only 30.370 km are districtualized (District Metered Areas – DMAs – are realized to obtain a precise control volume in a delimited area for an easier identification of losses) with active systems of automatic regulation of capacity and pressure.

The water infrastructure is aged and should be replaced for the major part. Unfortunately, in Italy almost only non-planned maintenance works are made (92%) and rates of replacement are much lower than needed.

The replacement timing observed by ARERA (Authority for the regulation of energy, networks and environment) was at 0,42% in 2015 (at 0,39% in 2014), while timing coherent with a technical life cycle assessment of 50 years should be set at 2%. This means that 1.417 km of water network have been replaced, compared to a demand of 6.750 km. In order to replace all 74.240 km of network more than 50 years old, it would take 52 years at the actual rate, while at 2% rate it would take 11 years. But in 52 years, the remaining infrastructure would be far more than 50 years old and a big part of it would be almost a hundred. Therefore, it is necessary to increase the replacement rate as soon as possible. Translated in economic terms, it would mean to pass from approximately 300 million Euros invested in replacement in 2015 to about 1,4 billion Euros, almost 50% of investments planned for total water sector in 2017 (according to ARERA) and 20% of the level of value of construction output for water services in Italy in 2017 (EUROCONSTRUCT, November 2018).

Furthermore, according to ARERA, interventions on the water distribution network are not the most important, representing only 19% of total investments planned in the period 2016-2019. The critical areas that require higher investments are those of wastewater depuration (29%) and sewerage (25%) activities[3]. In 2015 342 municipalities don’t receive wastewater depuration in Italy, and in 2018[4] 856 urban agglomerations are not yet compliant to the EU Directive on urban waste water treatment. This disregard costed a penalty of 25 million of Euros so far, to which 30 million of Euros[5] has to be added for each semester of delay[6] until full compliance to Directive 91/271/EEC of the 74 agglomerations subjects to penalty is achieved. But the agglomerations that do not respect the EU Directive are many more, and the adjustment process is very slow: from 2012 to 2018 only 177 agglomerations have been adapted to standards. With a pace of 30 agglomerations per year, it will take 28 years to adapt to standards all 856 not compliant agglomerations.

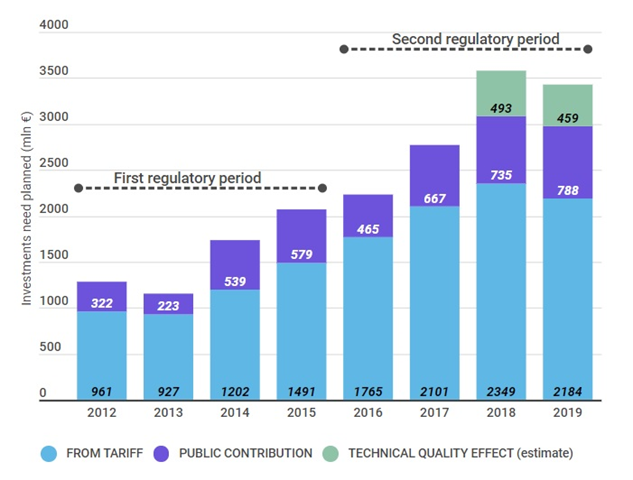

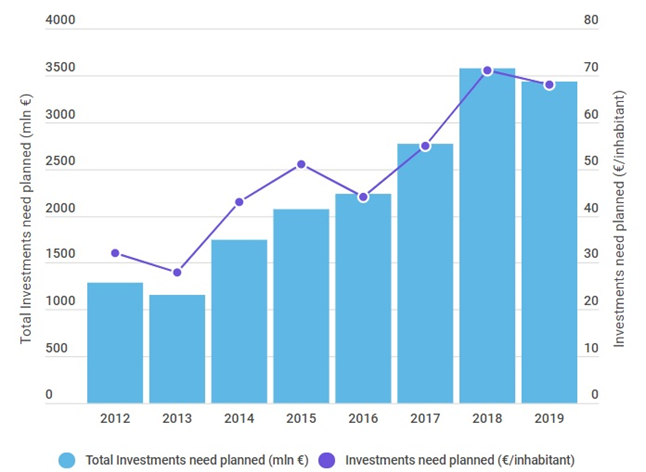

In such critical context is necessary to quadruple the investments in water sector and to intervene as soon as possible, before that the infrastructural stock loses worth. According to latest CRESME estimation, the value of construction output for water services in 2018 is estimated to increase by 1.5% in respect to 2017 and the positive trend is expected to be confirmed in the medium term. Data emerging from ARERA latest annual report confirm this scenario: for the period 2016-2019 investment amounting to 11 billion is planned by sample of companies managing hydric service. Moving from the sample to the universal, ARERA calculates a need for investment in the hydric sector of 12.7 billion in the period 2016-2019 (3.2 billion on yearly average). Looking at yearly data, it means that from 2012 to 2018 the investments planned are doubled: from 32 to 61 Euros/inhabitant, a level that further increases to 71 Euros/inhabitant considering ARERA’s estimate on the technical quality regulation effect (to reduce network losses and muds disposed in dump, to ensure the continuity of supply water, the water quality and the adequacy of the sewage system). Moreover the rate of realization of planned interventions also increased from 50% to 80%. However the infrastructure is ageing and the problem of water loss is yet far from being solved.

The main source of financing for investments in water sector (about 80%) derives from the tariffs applied to final users, that despite increased by 2,7% per year on average between 2012 and 2019, are still among the lowest in Europe. According to REF Ricerche estimation, increasing the tariff by 3,6% on yearly average, together with a coherent strengthening of policies and programs for low-income families, the level of investments financed only with tariffs could reach 80 Euros/inhabitant per year (without consider public contribution), a level in line with the best European experiences.

Figure 1: Trend of investments in integrated water service planned by source of financing in the regulatory periods 2012-2015* and 2016-2019**

In million euros

S: ARERA (8th of January 2019), referred to programs of intervention transmitted by utilities.

* From a sample of utilities providing hydric service to about 2/3 of the national population.

**From a sample of 148 utilities providing hydric service to 84% of the population (50.626.331 inhabitants).

Figure 2: Trend of investments in integrated water service planned in the regulatory periods 2012-2015* and 2016-2019**

In million euros and euros per inhabitant

S: CRESME elaboration on data ARERA.

* From a sample of utilities providing hydric service to about 2/3 of the national population.

**From a sample of 148 utilities providing hydric service to 84% of the population (50.626.331 inhabitants).

From 2019 also the role of public finance is expected to further strengthen. The 2019 Italian Budget Law allocated 400 million of Euros over a period of 10 years, to interventions aimed at increasing water infrastructure technical quality. In addition, Water Works Guarantee Fund has just been set up, that allocates about 250 millions of Euros, 50 million for each year from 2018 to 2022, to realize 30 priority works individuated in the Extraordinary Plan of Interventions in the Water Sector. The new hydric regulatory period 2020-2023 represents the opportunity to speed up the investments in water sector, thus positively impacting on the overall national economy, and more specifically on the construction market.