European construction sector set for moderate recovery in 2025

Milan, Italy – December 3, 2024 – The European construction market is going through a challenging period, marked by the persistence of external factors (e.g., the war in Ukraine), the effect of new one (the possible changes in US policy), as well as internal factors that continue to weigh on financial conditions (high interest rates and energy costs as well as increasing labour costs), that are hindering construction activity and investment plans. After a first decline in 2023, 2024 will be the most difficult year for the industry since 2020. However, forecasts point to a positive turnaround from 2025 onwards.

Market Overview

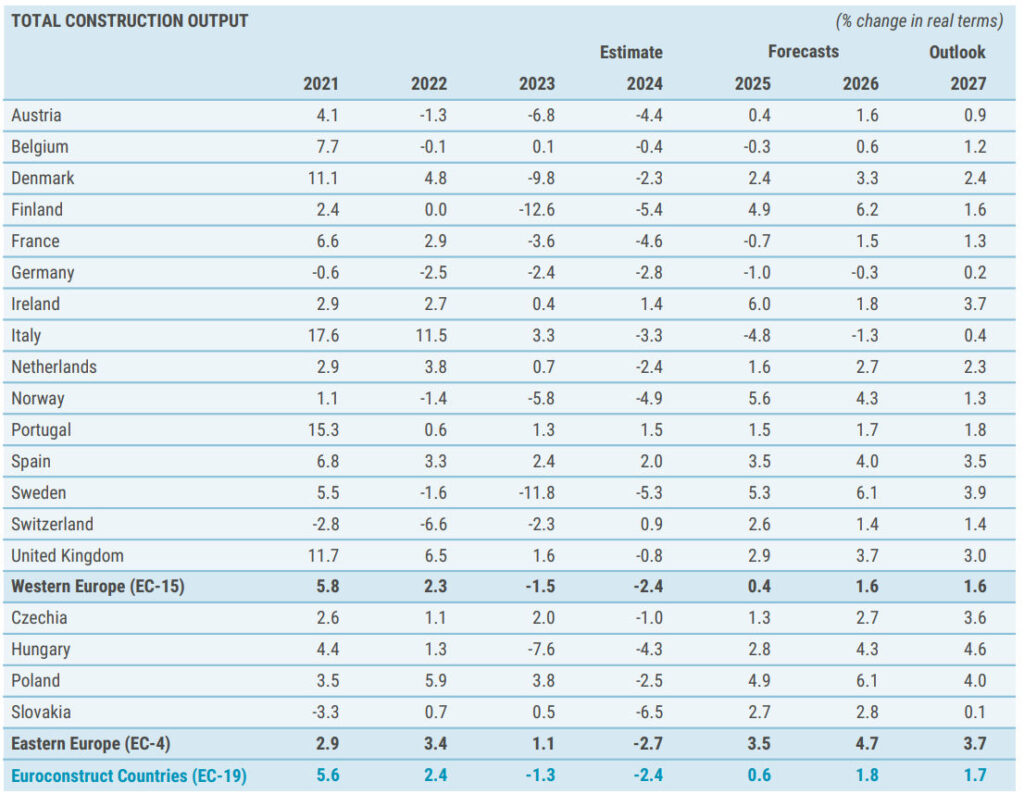

According to the new estimates, the construction activity in the 19 EUROCONSTRUCT countries is projected to decline by 2.4% in 2024, while a slight recovery is expected in 2025 with growth of just 0.6%, due to gain momentum in the following two years. This forecast represents a modest upward revision for 2024 by 0.3 percentage points compared to previous estimates, though the growth in 2025 is slightly weaker than initially anticipated, while the modest growth path for 2026 remains unchanged.

Residential Construction

The primary challenge for the European construction market in 2024 is the significant decline in new residential construction, follows that recorded in 2023. High property prices, still elevated interest rates (albeit declining) and high construction costs are the main obstacles. However, the sector is anticipated to stabilize in 2025, with growth accelerating in the following years. The residential renovation market is also in contraction, with a modest decline this year and a further decrease next year. An improvement in the housing sector is forecast from 2026 onwards, driven by demographic factors, economic conditions and more favourable subsidy schemes for housing renovation.

Non-Residential Construction

The non-residential construction sector has faced challenges, with a modest decline experienced last year. This downward trend is expected to continue this year, due to new non-residential construction projects that are under pressure. Despite these challenges, growth is projected to resume starting from 2025, with both new construction and renovation activities contributing positively to the overall non-residential construction sector. New investment will be particularly bright for the mainly public funded market segments, while incentives and structural policies targeting “green goals” will create consistent push for renovation activities across the sector.

Civil Engineering

Civil engineering remains a bright spot, driven by the urgent need for upgrades in transport networks and energy infrastructure. Investments in these areas are crucial to meet new demands and political goals. New civil engineering projects, after a weak 2024, are expected to grow significantly in the next two-year period, against a more stable and moderate development for renovation works, expected to be solid this year, with a gradual slowdown by the end of the forecast period.

Conclusion

Despite the current challenges, the European construction market is poised for recovery and growth in the coming years. Public support for refurbishment projects and significant investments in infrastructure will be key drivers of this positive trend.

Table 1: Evolution of construction output in the EUROCONSTRUCT 19 area

S: EUROCONSTRUCT (December 2024). – 98th Conference.

EUROCONSTRUCT forecast reports

All our forecasts are published in our reports – the EUROCONSTRUCT Country Report and the EUROCONSTRUCT Summary Report. Read more

About EUROCONSTRUCT

The 98th EUROCONSTRUCT-Conference was held in Milan on 3 December 2024, hosted by CRESME

EUROCONSTRUCT was founded in 1974 by specialised research organisations from France, Germany, Italy, the Netherlands and the United Kingdom as a study group for construction analysis and forecasting. It has since expanded from this core group to include almost all Western European countries and 4 Central Eastern European countries. Currently, EUROCONSTRUCT has member institutes in 19 European countries.

The objective of EUROCONSTRUCT is to provide information, analysis and forecasts to decision-makers in the construction sector and other markets related to the construction industry, to enable them to plan their business better and more effectively. The activities of the EUROCONSTRUCT network are also aimed at official institutions such as ministries or agencies, as well as national and international associations.